Currency Risk Management

Currency Risk Management

Lock in exchange rates for up to 12 months with Forward Contracts

Manage currency risks for foreign costs and revenues

Business customers can lock in the exchange rate for the foreign currency input costs and foreign currency revenues. Most losses due to currency fluctuation are avoidable and can be addressed with a forward contract. Importers, manufacturers, consultants and agencies can benefit from discussing their Forward Contracts with our team.

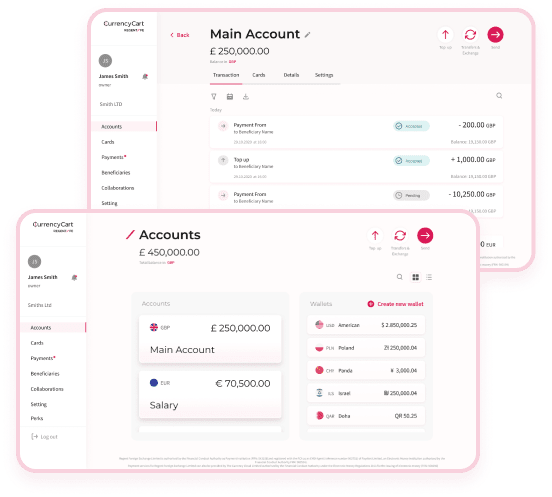

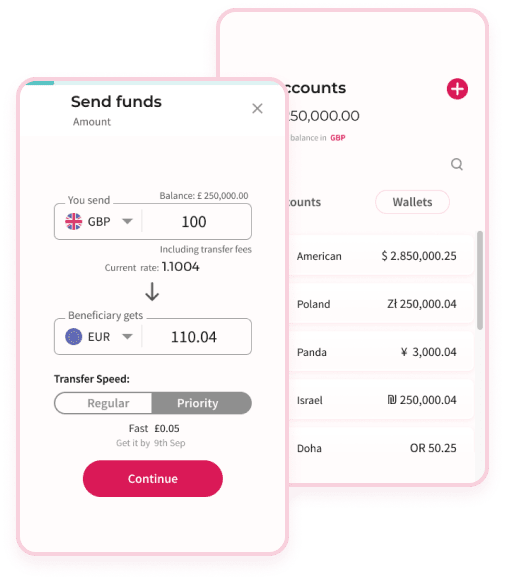

- Currency exchange at competitive rates for all business customers

- Lock in exchange rates for up to 12 months with Forward Contracts

- Small margin required on all forward trades. Margin must be maintained

- Exchange funds on account instantly and instruct payments

More features

Do you have questions?

What do you mean by currency risk management?

When you earn money in another currency or have input costs in other currencies then you can lock in the exchange rate into the future to ensure your margin remains protected.

Currency risk is one of the biggest contributors to profitability erosion for international companies.

Can I book any currency and amount for a future date?

Almost. Regent FE is offering 300 currency pairs, and the main ones you can lock in via a Forward Contract. Please enquire with us about a particular currency pair.

Do you require me to put a margin down for a Forward Contract?

Yes we do require a margin to ensure that if the rate moves against you we have some cover to guarantee possible negative movements in the market. Our customers always settle, and margin is a great instrument to give all parties peace of mind. Please email accounts@regentfe.com for more information